BANGKOK — Thailand is expected to attract 36.1 million tourists this year, compared with 39.9 million in 2019, with a full recovery not expected until 2025.

If you haven’t been here recently, you might be surprised at how different Thailand’s capital has become.

A global focus on health and wellbeing, and the local legalisation of cannabis, means you’ll find plenty of wellness centres, cannabis shops and street stalls in this chaotic, bustling city, which impresses foreign visitors with its juxtaposition of tradition and modernity.

I had just come from RAKxa Integrative Wellness Retreat in Bang Krachao, Bangkok’s green lung, where I met with an alternative medicine therapist who recommended a range of treatments – mainly asking me to lie down and receive the most soothing and healing treatments over three days.

After leaving RAKxa, I headed to the Movenpick BDMS Wellness Resort Bangkok, an Accor-owned hotel owned by BDMS Wellness Centre, the preventive medicine arm of Bangkok Hospital, which is opening wellness centres across the country.

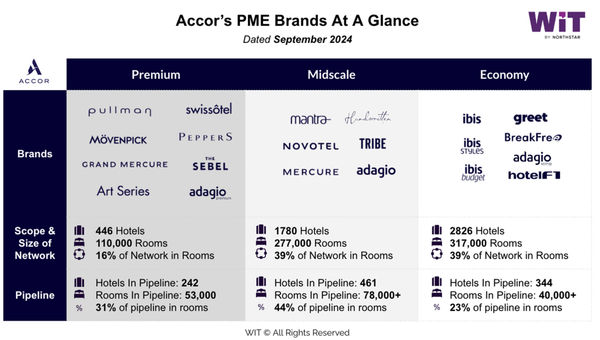

It was there that I met Benoit Racle and Jean-Yves Minet, a day after they were named as the new global brand presidents for Accor’s premium, midscale and economy brands. The two were introduced to the Accor Middle East, Africa and Asia Pacific commercial teams gathered in Bangkok.

Racle focuses on high-end hotels, including brands such as Pullman, Swissotel, Movenpick, Angsana and Peppers. Minet focuses on mid-scale and economy hotels, including brands such as Novotel, Mercure, Tribe, Handwritten Collection, ibis, ibis Styles, ibis Budget and Greet.

A luxury suite bedroom at the Movenpick BDMS Wellness Resort Bangkok. Photo credit: Courtesy of AccorHotels

Switch to Accor

Prior to joining Accor, Minette spent 14 years at Estée Lauder Companies, where he led the company’s $8.5 billion international division. I asked him why he chose to leave the beauty and cosmetics industry for a career in hospitality.

“I have always been interested in travel. I have been working in travel retail for six years, I make all the products we sell in duty free shops, and I have always been keeping an eye on travel routes and consumer tastes,” he said.

“There are so many opportunities in the travel industry that attract me. Although competition is very fierce, travel is one of the few industries where demand exceeds supply,” he added. “Emerging consumers in markets such as China, Turkey and India are becoming increasingly affluent. The middle class is rising; travel is the top desire of emerging consumers. Growth is almost inevitable. What’s most interesting is how to move beyond this.”

On the other hand, Raklee started working in the hospitality industry at the age of 15, working at the front desk of a small hotel, and later honed his skills at Starwood and W Hotels. “I’ve been a cook, a security guard, a general manager. Making guests smile and happy is what drives me in life. I will never leave this industry.”

He was drawn to AccorHotels’ culture and care for its employees. “The coronavirus pandemic broke my heart,” he said. “We had to stop working with a lot of people. In North America, we lost about 45% of our employees. AccorHotels has proven that it cares about its employees, and now we have to get them back into the business.”

Due to their different backgrounds, the two have different understandings of their new roles.

Racle spent a month on the road, visiting teams and properties across his brands around the world. “I wanted to understand the culture, what it meant to work with Accor for the team and the owners—to understand the nuances of each market. At this stage in my career, it was exhausting but refreshing to listen to the customer.”

“The second question is, what is our five-year plan? It takes time to build a brand; it’s a long-term vision.”

For his own “onboarding,” Minette spent time in the hotel, working in the kitchen, cleaning rooms, and managing the front desk. “I learned the business, trying to understand the processes, how the hotel operates, how we translate the value proposition of each brand into an experience. How do we keep innovating, bring something new to the consumer, consolidate the fundamentals and invest in the future? What will ibis look like in 20 years? We should be asking this question now.” (The ibis brand is described as “vibrant, casual, friendly” and has 1,278 hotels and 158,793 rooms.)

Focus on consumers

For both executives, the question is not how many brands each manages but how to stay consumer-centric.

“Consumers seek experiences; travel is about experiences,” Minette said. “Beauty is a physical product. The biggest difference is whether you add an experience before or after purchase; with so many physical products, it’s key for brands to create an emotional connection through experience.”

“The answer always lies with the consumer: to understand him or her better,” he continues. “In beauty, we do product development through research. Every year, we launch 10 to 15 new products with varying degrees of innovation: packaging, new formulas, sophisticated storytelling. I want to bring this knowledge to the hospitality industry. What does it mean for the hospitality industry – for example, samples?”

For Racle, his goal is to “make sure our brand has a point of view, something we want to stand for.”

At W Hotels, he focused on one brand and established a very clear positioning for the Marriott brand. He acknowledged the challenge of creating a single positioning for eight different brands.

“We have to build brands around one consumer and for that specific person. There’s nothing worse than a brand that’s not differentiated. Can we move from location-based to brand-based so people will go a little further to choose the brand they like?”

In many ways, this will help diversify the tourism industry, which is something some destinations desperately need. What role do hotel companies play in shifting development away from prime locations to more remote areas? From a real estate perspective, it may not make economic sense.

“Well, the guest asked for it,” Rackley said. “Take me to a place I haven’t been, where there are fewer people, where I can have purpose and influence.”

This generational change in consumer behavior will have an impact on hotel retail and distribution. I asked Minette what the hospitality industry can learn from the beauty industry in this regard.

“Accor is also very good at retail, with a large part of its business being online direct sales. The beauty (pun intended) of the hotel industry is that it can be truly multi-channel, just like the beauty industry. Consumers don’t buy in just one place. The only difference is that in beauty, the products are the same, especially in the high-end. In travel, it’s all about the local experience. Mercure is about ‘serving local’, and it’s going to be different in Indonesia than it is in Italy.

“More and more brands are looking to expand their direct sales channels because it allows you to establish a direct connection with your customers and strengthen the relationship with them.”

Racle added: “That’s the brand promise. If you book direct with us, we’ll give you the best price, we know you, we recognize you. That’s our promise.”

That’s where loyalty comes in, he said. “Consumers are looking for bigger loyalty programs, and that’s why hotel groups are creating brands within ecosystems. Our job is to provide accommodations for consumers at different stages of life so that we can grow with the consumer.”

Image source: Web in Travel

Which brand is exciting?

When asked which brand they like best, Minette said: “I am not yet familiar with all the brands, but Accor’s parent brand Novotel has the longest heritage. It embodies the essence of hospitality. It has a strong DNA, financial strength and assets to meet the needs of travelers.”

He also mentioned Greet, a “locally engaged, collective, circular hospitality” brand that operates primarily in France with 36 hotels and 2,499 rooms. Greet also operates in Austria and Germany and will soon open in Brussels.

“It’s aimed at a very specific consumer, has a very interesting positioning, uses recycled materials, including beds and furniture, and the staff are ‘Second Life’ – from marginalized communities,” Minette added. “There’s a social element here and there’s a lot of potential. A lot of people care about how they consume.”

For Racle, he firmly believes that “the fusion of luxury, hospitality, fashion and art can bring people a unique experience”, and Pullman is his first choice. Pullman originated in the 20th century and is known as “a pioneer and a pioneer of innovation”. It has 157 hotels and 44,624 rooms worldwide.

“We are reinventing the brand to be more socially open for culturally savvy travelers. It features the best of iconic hospitality with social spaces and incredible programming. I saw the first new Pullman hotel in São Paulo and I’m excited about the future of the brand.”