A strong loyalty program can help hotel brands reduce customer acquisition costs, increase direct-to-consumer opportunities, and offset occupancy shortfalls during lean periods and weak economic conditions. After analyzing public data from five large hotel companies, we found that while growth in several key metrics slowed in 2023, loyalty members’ overall contribution to occupancy increased, although each member’s marginal contribution increased. contracted.

benefit

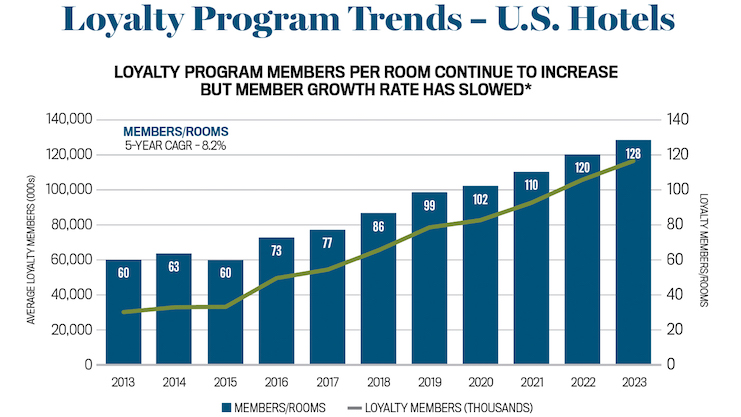

The average number of loyalty program members across the five companies grew 11.3% in 2023, down from 15% growth in 2022. The number of members per room increased by 6.4% year-on-year, from 120 to 128.

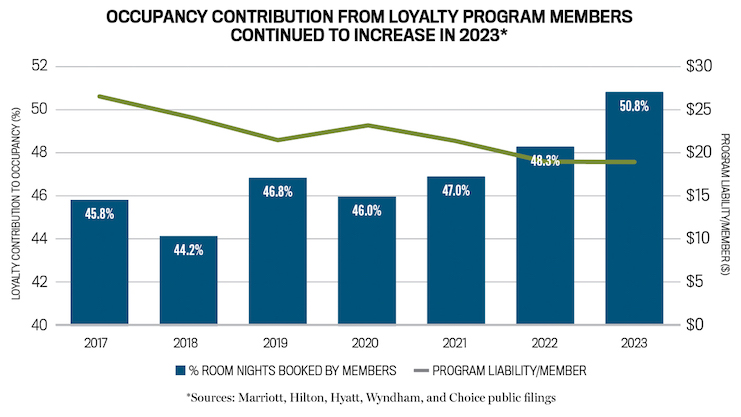

The average contribution of loyalty members to occupancy rates will increase from approximately 48% in 2022 to nearly 51% in 2023. However, loyalty programs dominated by frequent travelers (more than 30 nights per year) are becoming increasingly rare. The average number of room nights booked by loyalty members in 2023 is 1.1, which has returned to the level of last year in 2019. This is well below the 1.8 nights per member in 2016, suggesting that the share of members who are heavy users is declining as these programs become more closely associated with credit cards and affiliate programs and less with frequent travel . This doesn’t mean members are less valuable, as they may have different travel patterns and fill periods of seasonal decline or soft demand, but the trend does suggest that the loyal member base is contributing fewer nights than it was in 2016.

responsibility

From a brand perspective, loyalty program liability per member (i.e., the average dollar value each member accrues through unredeemed points) ends 2023 at 87% of pre-pandemic levels. Loyalty points redemption revenue grew 11% last year, to $1.1 billion from $982 million in 2022. This may indicate that more points will be redeemed to book rooms in 2023; however, this may also be due to a 4% increase in ADR or a depreciation in the value of loyalty points required to earn free nights.

cost

The business costs incurred in maintaining the loyalty program are covered by fees charged to the hotels in the system. According to the 11th edition of the Uniform Accounting System for the Lodging Industry (USALI), guest loyalty program fees include “any fees associated with a program designed to build guest loyalty to a hotel or brand.” To better understand the latest trends in guest loyalty program fees, CBRE analyzed loyalty program fees paid by 4,454 U.S. hotels from 2022 to 2023 in the Hotel Industry Trends database. In 2023, these hotels had an average of 215 rooms, achieved an occupancy rate of 69.3%, and an average room rate of $211.44.

In 2023, guest loyalty program fees will account for an average of 1.5% of total operating revenue, with the highest proportions among upscale hotels (2%), upscale hotels (1.6%) and ultra-upscale hotels (1.6%). Budget hotels (0.3%) and midsize hotels (0.9%) have the lowest loyalty fees as a percentage of total operating revenue. To some extent, this metric serves as a proxy for the size of the chains that benefit most from guest loyalty members staying at (paying) hotels and earning points. In general, loyalty program members travel most often to conferences and business events, which explains the preference for higher-priced chains. Since loyalty program fees are charged as a percentage of revenue, it’s no surprise that luxury and upscale hotels have the highest fees on a dollar per room (POR) basis, with midscale and budget hotels the lowest.

Guest loyalty program fees are typically charged as a percentage of gross revenue earned when loyalty program members pay for their stays and earn points. Therefore, with loyalty program fees growing faster than total operating revenue, it can be assumed that loyalty program members represent an increasing share of paying guests year over year.

From 2022 to 2023, total operating income for CBRE’s sample increased by 8.8%, while guest loyalty program fees paid increased by 17%. The largest differences between revenue and loyalty program fee growth are observed in the premium, economy and upper-midrange segments.

for our trend The investigation revealed that CBRE collected four different franchise-related fees: royalties, marketing evaluations, reservation fees and guest loyalty program fees. From 2022 to 2023, loyalty fees will increase the most among the four components, reaching 17%, while the other three components will all increase by less than 10% through 2023. The magnitude of the year-over-year change confirms the growing proportion of paying guests among loyalty fee program members. It can be assumed that hotel companies will increase the cost of all four franchise-related fees, so the large increase in guest loyalty fees paid must be attributed to an increase in the number of loyalty guest stays.

cost transparency

In addition to guest loyalty program fees, hotel owners are responsible for paying for additional amenities and services provided during a loyalty program member’s stay. Such charges may include complimentary food and beverages, upgraded room and housekeeping services, points provided as compensation for service failure, and access to an exclusive executive lounge.

To provide hotel owners and operators with a deeper understanding of these costs, the 12th edition of USALI includes new loyalty program fee categories in the Rooms, Administrative and General, and Sales and Marketing departments. CBRE will begin benchmarking these additional costs in 2026 as the industry adopts the new USALI.